Understanding the Value of Gold Bullion and How to Buy & Sell It

To understand the value of gold bullion and why it has been valuable for thousands of years, there are a few details we need to understand about its origins and why it continues to be a timeless asset.

As of market close, February 13th 2020, the market price of gold was 1574.50 US dollars per ounce. 5 years ago the price sat at 1230.25 US dollars per ounce. Although there are typical ebbs and flows of the price for gold, with the 5-year low hitting $1060.85 to start 2016 and a recent high of $1589.90 on January 31st, 2020, the overall the price of gold has been steadily increasing over the long term since it was first exchanged as currency.

When it comes to buying and selling precious metals such as gold, what people are trading today is a mix of gold bullion, gold bars, ingots, jewelry and coins. In any form, the gold is equivalent to its weight of pure gold, a measurement typically evaluated by professionals.

Do you have a supply of gold bullion and are wondering what it is worth? Think Keno Brothers.

Keno Bro’s is a highly accredited source to sell gold bullion in South Florida. Quickly call our gold experts experts now at 954-763-5366 or visit our store at 2000 East Sunrise Blvd. Ft. Lauderdale, FL 33304 to start selling your gold.

If you are interested in buying gold bullion, then start learning more gold bullion now. Since gold bullion has proven to maintain its value better than other currencies, governments and private citizens alike tend to keep it as a backup store of value. It is widely practiced that investors keep 10% of their investments in gold or other precious metals. Simply because when you invest in gold you offset the risk of the currency market, inflation rates, geopolitical risks all while simply diversifying your investment portfolio.

We recently wrote two other valuable guides on selling diamonds and selling Rolex watches that might interest you. All of these guides are intended to boost your investment and selling knowledge of jewelry, precious metals, watches and more.

Here are the top 5 smartest ways to buy physical gold:

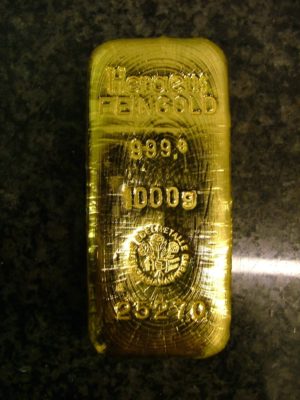

The specifications of gold bullion is determined by legislation and other market bodies. For instance, the European Union qualifies gold bullion as an investment asset if a gold bullion bar is 99.5% pure gold or a gold bullion coin is 90% pure. While the London Bullion Market Association sets and promotes the standard of gold for the over the counter market.

To ensure a gold bullion is legitimate, each bar will have a specific serial number and certificate of authenticity. Many refineries stamp serial numbers on the bars, and the number on the bar should match the number on its accompanying certificate.

According to the US Mint, the typical size of a gold bar is 7 x 3 5/8 x 1 3/4 inches. The standard gold bar held by central banks is the 400-troy-ounce (438.9-ounce) bar, commoningly known as the Good Delivery gold bar. While the more manageable kilobar, which is 32.15 troy ounces, is used for trading and investments. The world’s largest gold bar comes in at 551 lb, measuring 17.9 in × 8.9 in and 6.7 in, which was valued at approximately $10.325M US this past May.

In response to the global financial crisis, Global Banks have converted from net sellers of gold to net buyers of gold. Back in 2010 the global net purchase of gold was as low as 79 tonnes, while in 2018 the net purchase of gold hit 651 tonnes.

As it stands today, according to the World Gold Council, these are the top 10 countries with the most gold reserves.

10. Netherlands

The Netherlands has 612.5 tonnes of gold and is likely to move up the ranks this year.

9. India

It is no surprise that the South Asian country, India has the world’s 9th largest reserves of gold, sitting at 618.2 tonnes.

8. Japan

Japan with the world’s third largest economy needs to have a big supply of gold on reserve, which in 2019 reports at 765.2 tonnes.

7. Switzerland

Per capita, Switzerland actually has the world’s largest reserves with 1040 tonnes.

6. China

Since December 2018, China has been on a gold buying spree bringing them to the 6th largest gold hoarder in the world with 1036.5 tonnes.

5. Russia

For the past seven years the Russian Central Bank has been the largest buyer of gold, trumping China in 2018 to bring them to have the 5th largest gold reserves in the world with 2,219.2 tonnes.

4. France

France is making a concerted effort to maintain their gold reserves by halting sales of the nation’s gold, which allows them to maintain the world’s 4th largest supply of gold at 2,436.1 tonnes.

3. Italy

Italy has always been a strong believer in the protection power that gold has against fluctuations of the dollar, which is why they are sitting on the world’s third largest mound of gold, 2451.8 tonnes.

2. Germany

Just recently in 2017, Germany moved over 650 tonnes of gold from banks in France and the United States back to their own vaults and have been steadily investing in the precious metal since, amounting them with 3,266.9 tonnes as of September 2019.

1. United States

The superpower, the United States, now claims nearly as much gold as Germany, Italy and France combined with a current reserve of 8,133.5 tonnes.

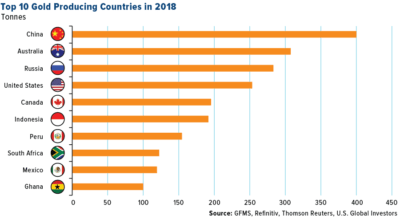

According to the Government Finance Statistics Manuals, the 2018 numbers show the world’s top 5 gold bullion producing countries as follows.

1. China

In 2018 China produced 12 percent of global mine production, excavating 339.7 tonnes.

2. Australia

For 6 years Australia has shown an increase in gold production, up by 6% in 2018, generating 8% of the countries GDP with the 312.2 tonnes.

3. Russia

Over 80% of European gold comes from Russia and the country shows no sign of slowing down as they have been increasing production since 2010, coming up with 281.5 tonnes in 2018.

4. United States

Over the past 5 years, the US has also been producing more gold each year, which is largely coming from Newmont’s operation in Nevada. 253.2 tonnes of gold rose from US soil in 2018.

5. Canada

Working their way up the gold production ranks is Canada, producing 17 more tonnes in 2018 than 2017, accumulating 193 tonnes.

Other big players in gold production in 2018 included Indonesia with (190 tonnes), Peru (155.4 tonnes), South Africa (123.5 tonnes), Mexico (121.6 tonnes) and Ghana (108.8 tonnes).

The rarity and distinct physical characteristics of gold make the metal so valuable. For one, gold does not oxidize or rust like other metals. The only way you can corrode gold is with a highly toxic mix of nitric and hydrochloric acid. Plus, gold is the most malleable and ductile of all the metals.

According to Science Engineering & Sustainability, one ounce of gold can be drawn into more than 49.7 miles. of thin gold wire and one ounce of gold can be beaten down to cover 9 square meters and 0.000018 cm thick. Plus, gold is very efficient for the transmission of heat and electricity. According to NASA, a thin layer of gold on an astronaut’s helmet visor fends off dangerous effects of solar radiation. Satellite microelectronics that instantaneously relay data around the globe depend on gold components to ensure reliable, corrosion-resistant and static-free performance. Basically, gold is the Chuck Norris of metals.

Looking to sell your Gold Bullion in South Florida?

Now that you understand gold bullion better, you should be more confident in making an investment in the currency or understanding why now is a great time to sell.

There are many reliable online trading platforms and financial institutions that make purchasing precious metals a seamless process. Best of luck with your gold ventures.

Call our South Florida Gold Bullion Buyers at 954-763-5366

Or visit our store at 2000 East Sunrise Blvd. Ft. Lauderdale, FL 33304 to start selling your gold.